DJC#019 – UTMA/UGMA Accounts: Building Financial Foundations for Your Mini-Me

It’s time to take your financial prowess to the next level now that you’ve successfully opened a high yield savings account for yourself and your little one…and transferred the money from your nose-bleed low interest savings account to your new one. If you haven’t done this yet, stop and go back to last week’s newsletter before taking this next step.

Today I’m talking about UTMA/UGMA accounts – those secret weapons for building a solid financial foundation for your little one. Yes, a high yield savings account is a must for short-term financial goals, but what about the long term? So, get ready to unlock the potential of these accounts and empower your kiddos with the gift of financial know-how. Let’s dive right in so you can start learning and your child can start earning.

UTMA/UGMA Accounts

UTMA/UGMA accounts stand for Uniform Transfers to Minors Act/Uniform Gifts to Minors Act accounts. Fancy names, I know, but here’s the deal – they’re financial accounts that allow you to save and invest money on behalf of your child until they reach adulthood. These custodial accounts that you set up on your child’s behalf and manage, but they own the account – they just cannot access it until they become an adult (ages vary by state). Once your child reaches that specific age and becomes an adult, the money is all theirs.

Benefits of UTMA/UGMA Accounts

Now that we’ve got the basics covered, let’s talk about the cool benefits of UTMA/UGMA accounts:

- Easy-Peasy Money Management: UTMA/UGMA accounts are a breeze to set up. You, as the parent, can set up your child’s account through any financial institution that offers these products. Do some research, but Vanguard or Fidelity are always good options.

- Versatile Savings and Investments: These accounts allow you to stash away money and invest it in a variety of assets, such as stocks, bonds, or mutual funds. It’s like building a financial nest egg for your kiddo’s future!

- Financial Education Opportunities: UTMA/UGMA accounts provide a fantastic opportunity to teach your child about money management and investing. As they grow older, involve them in discussions about the account, imparting valuable financial lessons along the way. I login and show our son his account to see the ups and downs of the market and see how his money has grown over the years.

- Give the Gift of Generosity: Family and friends can contribute to your child’s UTMA/UGMA account, making birthdays, holidays, and special occasions even more meaningful. It’s like a team effort in building a solid financial foundation for your little one.

- Financial Flexibility: While the funds in UTMA/UGMA accounts are intended for your child’s benefit, they can be used for various purposes, such as education expenses, buying a car, a house, or even starting a small business. It’s all about setting them up for a bright financial future.

Contributions, Limits & Taxes

The great thing about these accounts is that anyone can contribute. You want to set up a monthly auto transfer to that account – go for it. You want to tell the grandparents no more toys for birthdays and Christmas and instead gift money to the account – go for it.

There are no contributions limits for UGMA/UTMA accounts so sky’s the limit on how many chips you can stack for your child. Individuals can contribute up to $17,000 free of gift tax in 2023 ($34,000 for a married couple). There’s also no minimum to open an account, although certain investments may require a minimum initial investment.

One of the key tax benefits of UGMA/UTMA accounts is that the investment earnings within the account are generally taxed at the child’s tax rate. This is typically lower than the tax rate applied to adults with higher incomes. However, if the child’s investment income exceeds a certain threshold (known as the “kiddie tax” threshold), a portion of it may be subject to the parents’ tax rate.

One other important thing to keep in mind – since the money is owned by your child, this can impact financial aid for college (if that’s a path your child chooses). For the education/college saving/investing path, you’ll want a 529 savings account (stay tuned for next week’s newsletter).

Empowering Your Child’s Financial Future

As parents, we want to equip our children with the tools they need to thrive in the real world. UTMA/UGMA accounts are a fantastic way to lay the groundwork for their financial future, teaching them important money skills along the way.

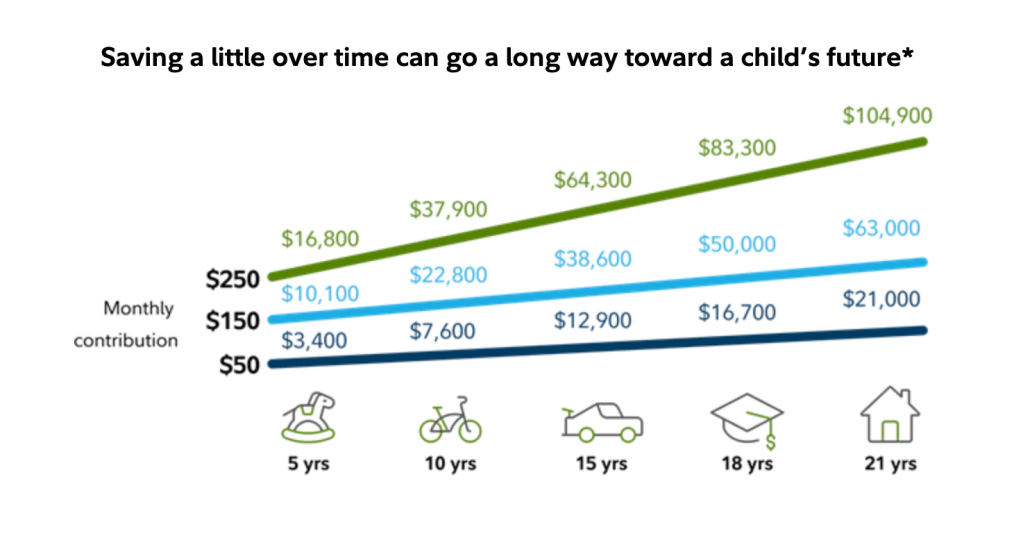

So as you’re learning about these money vehicles, teach your little ones so they too can become financial gurus. By opening UTMA/UGMA accounts, you’re setting them up for success and giving them the confidence to navigate the world of money like pros. As you can see in the chart below, the earlier you start the more they’re going to have. The best time to start saving and investing for your child was in the past. The next best time is now.

Leave a comment